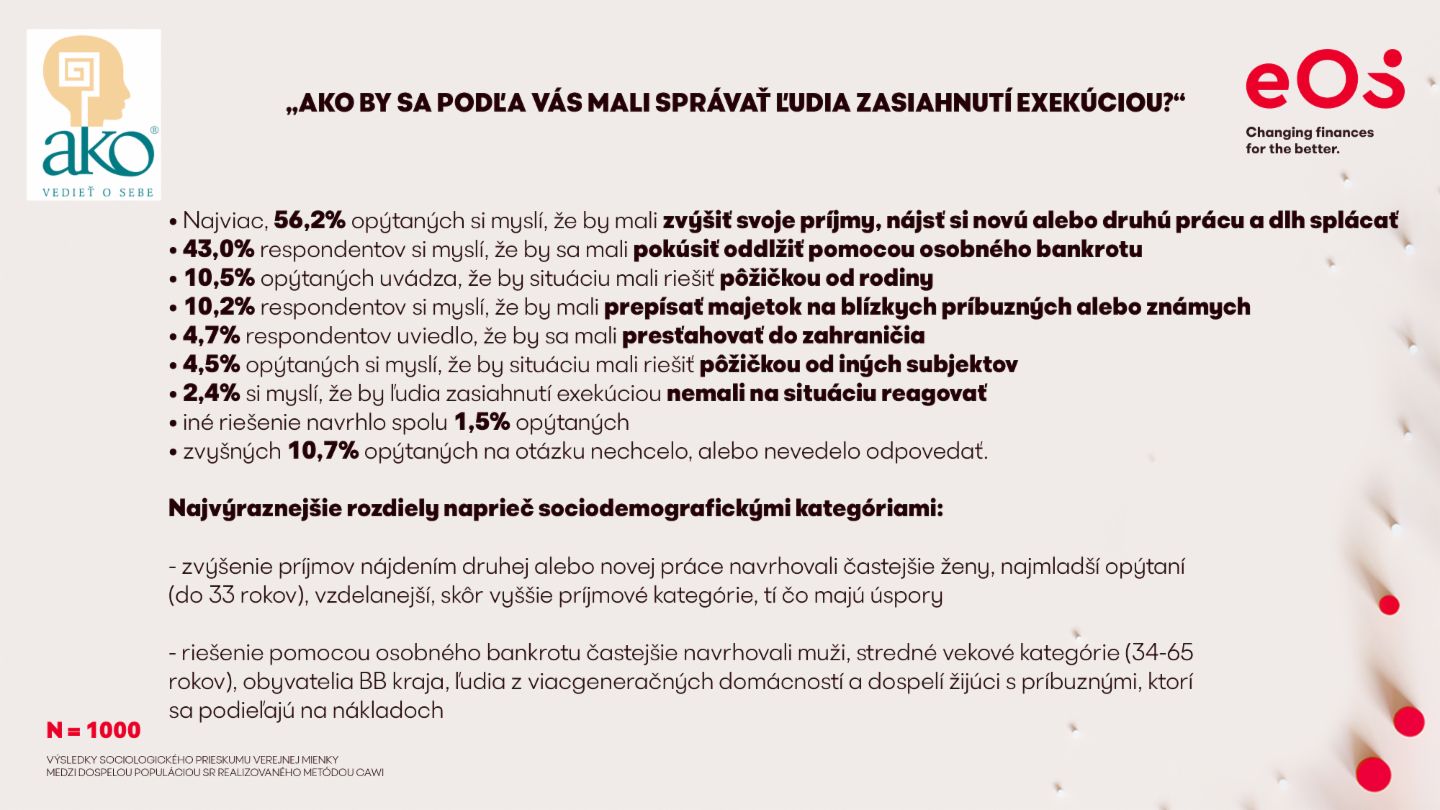

More than half of the respondents, 56.2 percent, when asked 'How should people affected by debt collection behave,' chose increasing income by finding additional work and repaying the debt as their first choice. This includes 58% of women and 54% of men surveyed, young people under 33, more educated population groups, higher income categories, and those who have savings.

Women behave more responsibly and actively solve problems

The second most preferred solution for debt collection issues according to the survey was attempting to get out of debt through personal bankruptcy. This solution is preferred by 43 percent of respondents, more often men, middle age categories from 34 to 65 years, residents of the Banská Bystrica region, people from multi-generational households, adults living with relatives who share expenses. Here too, women proved to be greater fighters: 37% of responding women would choose personal bankruptcy, compared to half, 49% of responding men.

'Men look for simpler solutions such as personal bankruptcy or fleeing abroad to avoid debt collection, while women behave more responsibly and actively address the problem,' interprets Václav Hřích, director of the AKO research agency.

Every tenth respondent, or 10.5 percent, would solve their debt collection situation with a loan from family, and approximately every tenth respondent, 10.2%, would neither look for another job, choose personal bankruptcy, nor borrow from family, but would try to transfer property to close family or a friend.

Moving abroad or becoming 'invisible' are not good solutions

Among other solutions that people in debt collection would use is relocating abroad. Some respondents even openly stated they would try to behave 'invisibly' and not respond. Younger age categories from 18 to 33 years showed more inclination toward escaping debts in the survey.

Ideas about transferring property to relatives are universal across all education level categories, with both primary school and vocational school graduates as well as university-educated people resorting to them.

'Not responding, not communicating, or going to live abroad is definitely not the right way to deal with your obligations. In today's world of interconnected information systems, it's no longer possible to exist unidentified even abroad; debt will catch up with you sooner or later. It's better to approach debts actively, communicate, and agree on a payment schedule,' concludes Peter Dvornák, CEO and Executive Director of EOS KSI Slovakia, summarizing the survey results.

Explore more from EOS