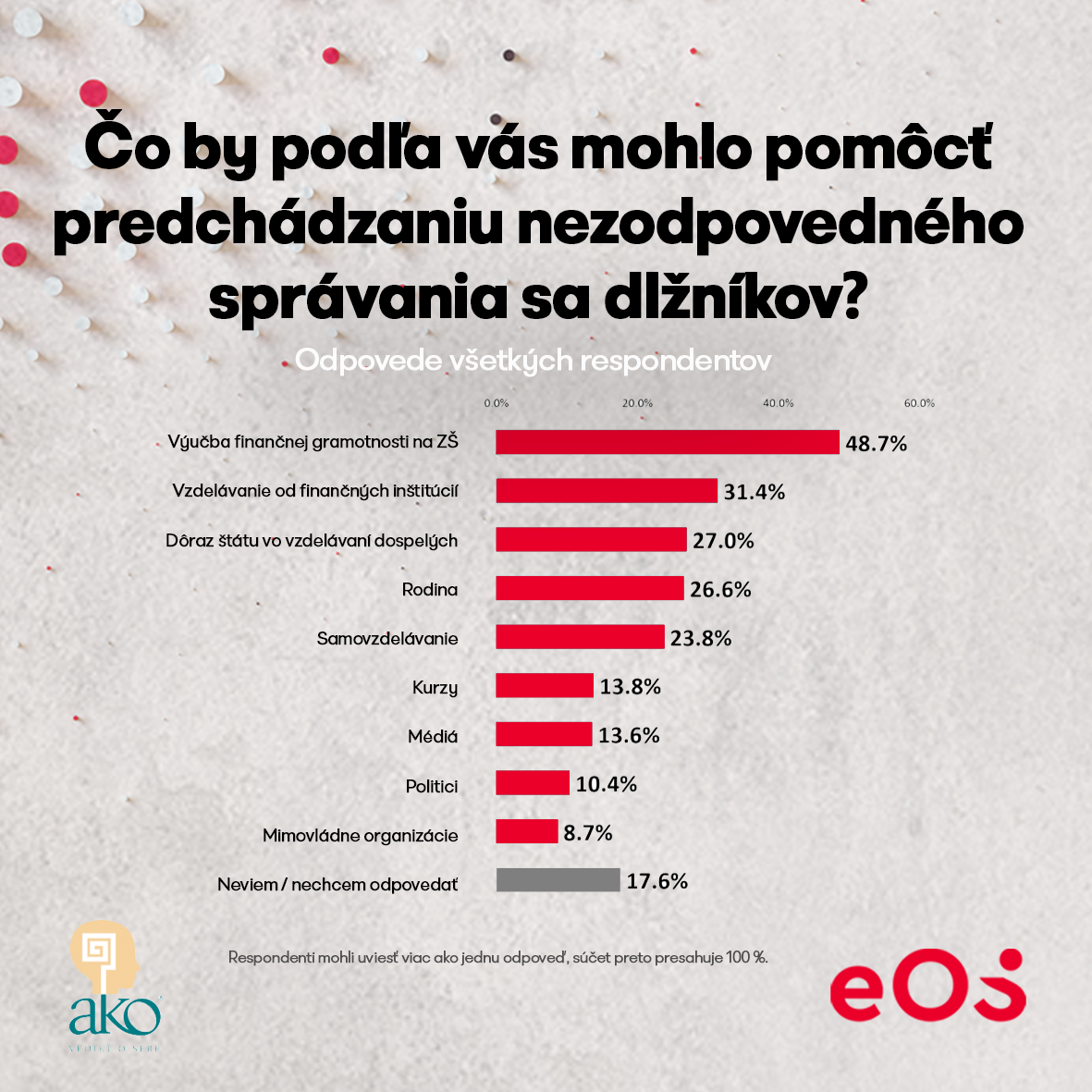

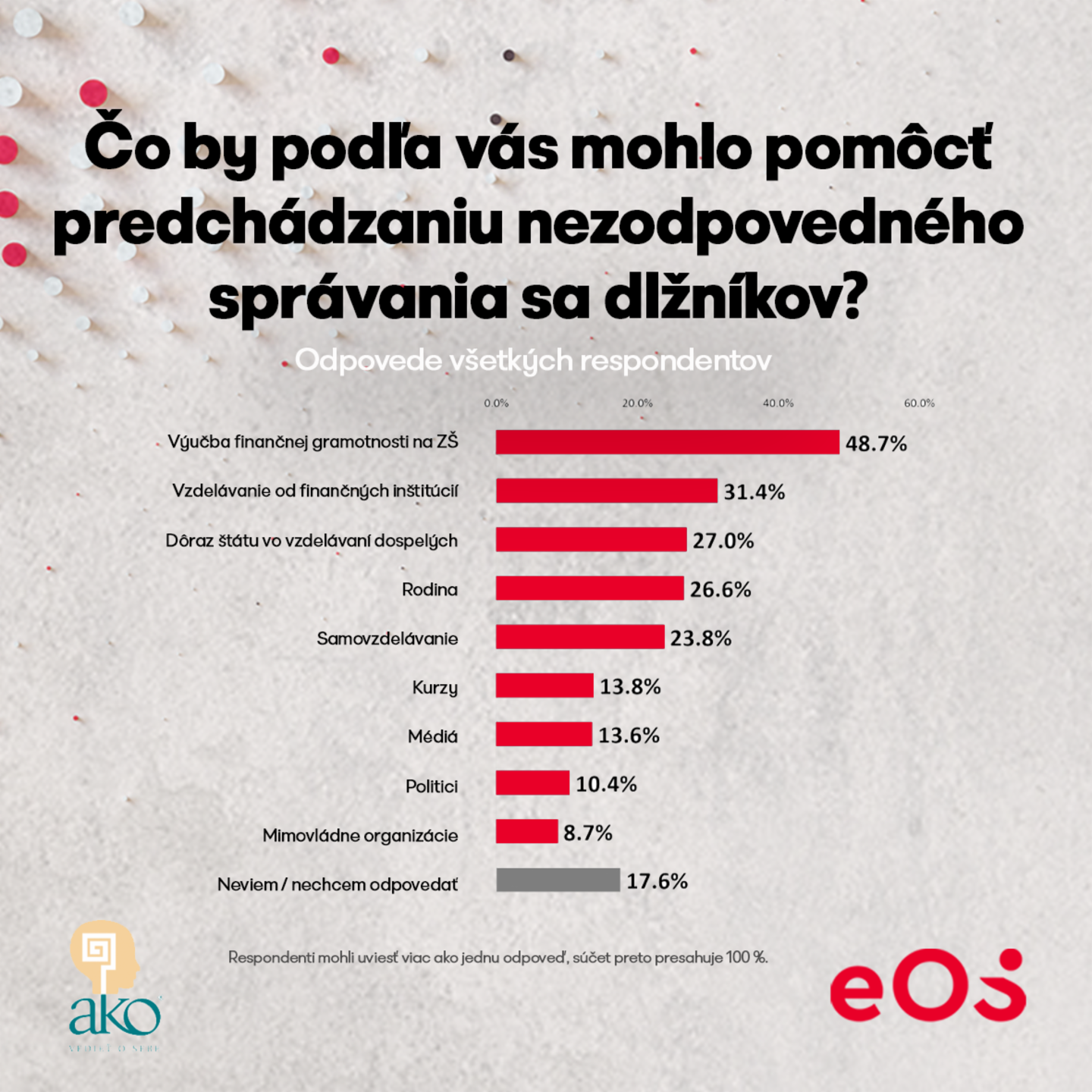

Increasing taxes and rising expenses will affect everyone, and many cannot overcome hard times without a loan. An exclusive survey commissioned by our debt collection company EOS KSI Slovakia showed that almost half of respondents see teaching financial literacy in primary schools and by financial institutions as the most effective prevention against financially irresponsible behavior.

Respondents answered the question: What do you think could help prevent irresponsible behavior of debtors?

As many as 48.7 percent consider teaching financial literacy in primary schools to be the most effective prevention against irresponsible behavior in the form of debt traps. In some primary schools it is taught, in others less or not at all.

"We should definitely not underestimate this path of education in primary schools," comments our colleague Andrea Slezáková, lecturer at the Finlit Foundation, which focuses on teaching children about financial literacy, adding: "But we should not underestimate the development of the financial market and its products either. The end of basic education should not mean the end of our education in financial literacy."

Nearly a third of Slovaks, 31.4 percent, believe that education from financial institutions should also precede indebtedness. The director of the AKO agency, which prepared the survey for our company, Václav Hřích, considers this an "interesting fact." "It's as if people expect the institution they communicate with and from which they may take loans to teach them how to behave responsibly," he reflected on this finding.

According to further data, up to 27 percent of respondents think that the state should emphasize financial education for adults, and a quarter of respondents (26.6%) mentioned family.

"This means that every fourth respondent says that family is the place where we should learn to handle finances. One can certainly agree that family should be a platform that teaches us to behave financially responsibly. But here too, it depends on the extent to which parents are financially literate," points out the director of EOS KSI Slovakia, Peter Dvornák, adding that he sees room for further education here.

"At EOS KSI, we know that financial literacy is life literacy. And insufficient financial literacy can lead to wrong financial decisions in life. On the Finlit Foundation platform, we have therefore developed a unique ManoMoneta program and trained lecturers who work directly in the field - in primary schools," highlights the significant activity of our EOS Group, the director of EOS KSI Slovakia, Peter Dvornák.

In the survey, further responses to the question "What do you think could help prevent irresponsible behavior of debtors?" include that information on how to avoid debt should also be obtained through self-education, courses, or media. Only 10 percent of respondents trust information from politicians, and a slightly smaller group trusts non-governmental organizations.

"Respondents who emphasized the role of the state in adult education seem to feel that they don't have information, and who else but the state should teach them. These respondents are effectively saying that it's not their fault they don't have enough information," concludes the findings of the EOS KSI Slovakia survey by the director of the AKO research agency, Václav Hřích. Men, the youngest respondents, the more educated, and those with higher incomes proposed more solutions to prevent problems with falling into debt traps. Women, older people, less educated people, and those with lower incomes had fewer solutions.

Note: Respondents could give more than one answer, so the total exceeds 100%.

Maroš Antol

Sales Support Specialist

Phone: T: +421 (0)2 32300-351

Explore more from EOS