57 per cent of Slovaks think that financial education at primary school is insufficient.

Bratislava, 20.9.2023

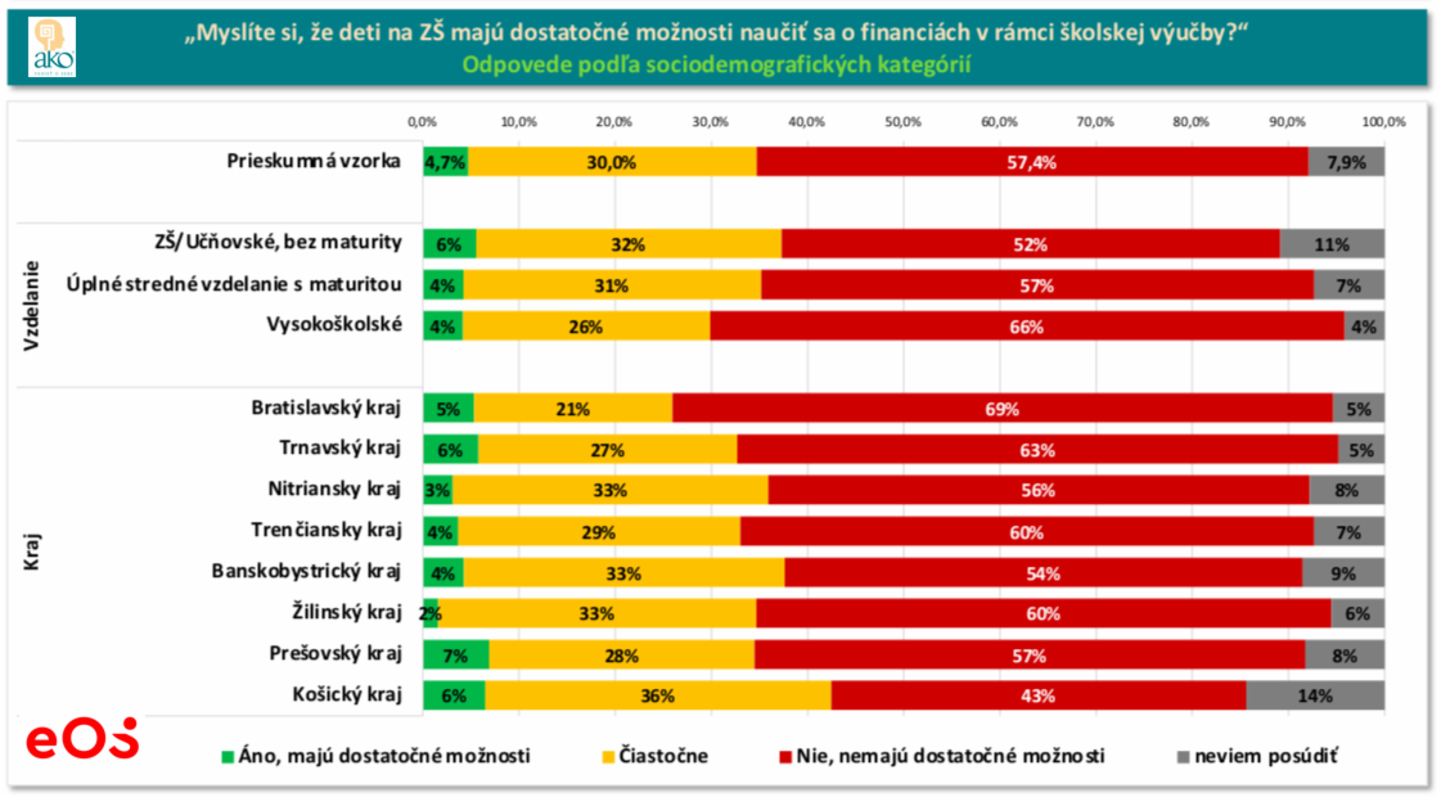

57.4 per cent of the adult population describe the opportunities to learn about finance in primary school as insufficient. Three out of ten Slovaks surveyed consider these opportunities to be partially sufficient and only one in twenty respondents, or 4.7 per cent, consider them sufficient.

The data are the result of a recent survey conducted by EOS KSI Slovensko in cooperation with AKO.

"This is an alarming state of affairs," says EOS KSI Slovensko Managing Director Peter Dvornák."Financial literacy from school age promotes the ability to manage responsibly and optimally handle finances in everyday life in adulthood," he points out.

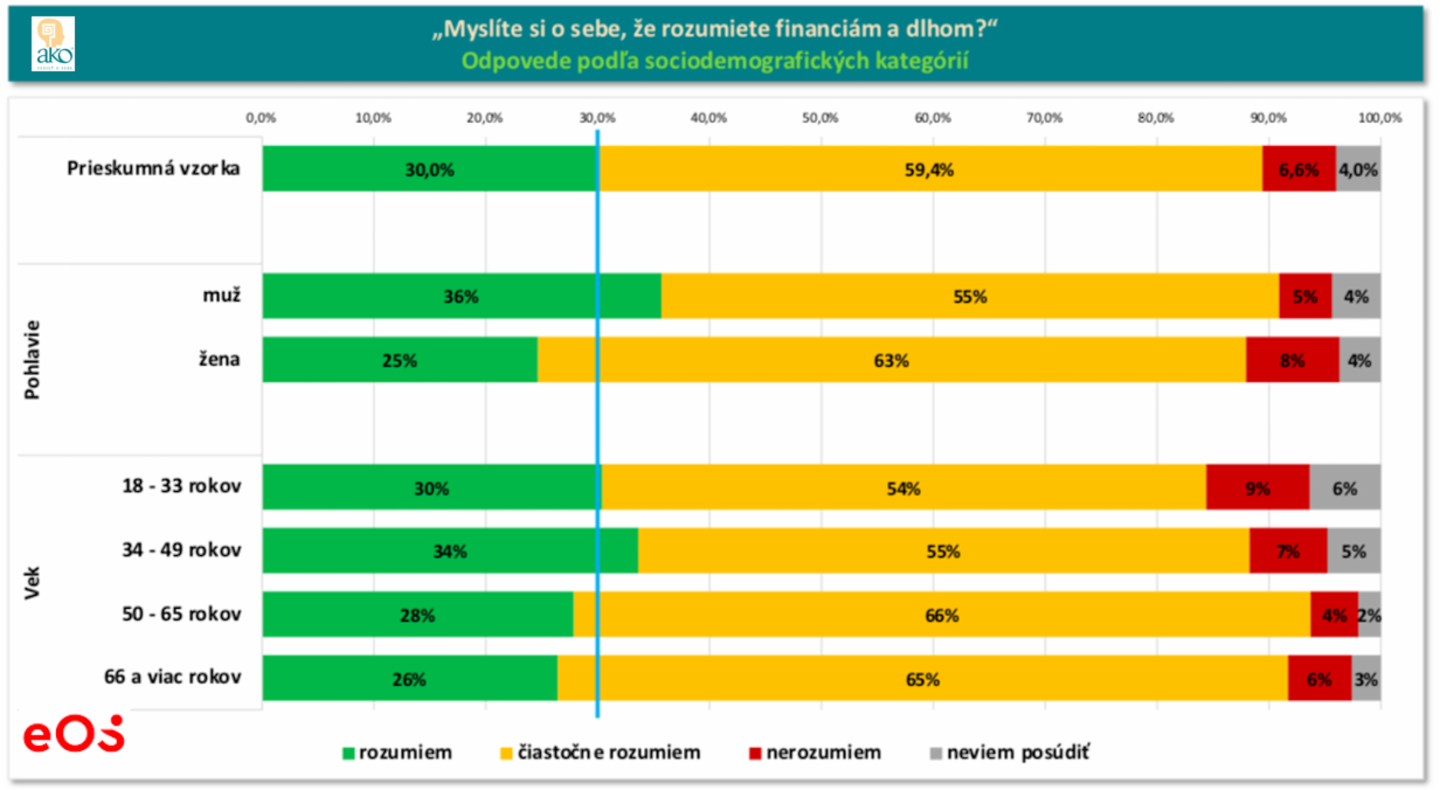

The survey also shows that even 6 out of 10 Slovak adults are not confident about their knowledge of finances and debt. Almost 60 per cent (59.4) of Slovak adults gave a verbal answer to the question "Do you think you understand finance and debt": "Partially." 6.6 percent of respondents admitted that they did not understand the issue at all, and 4 percent could not judge.

"We should always keep in mind that we need to educate ourselves, because no one will take care of our money better than ourselves," says Andrea Slezáková, expert guarantor of the volunteer financial education project under the auspices of EOS KSI Slovensko, adding that: "Those who understand money are ultimately able to keep it."

The level of teaching children in primary school about finance is perceived as insufficient above average by: young people aged 18-33 (68%); seniors 66 plus (60%); people with an income of over €1,200; people residing in the Bratislava and Trnava regions; Slovaks who have never had debts to companies or institutions (not family and friends) (63%), as well as those who currently have loans (61%).

Experts in the field of financial education have experience that children as early as 4th grade of primary school are able to understand and work with the issue if it is presented appropriately. "It is therefore advisable to discuss finance with children actively at classroom (teacher-student) level and in the home. This paves the way for a better perception of the value of money and more effective financial decisions in the future," concludes EOS KSI Slovakia Managing Director Peter Dvornák.

More about the basic principles of financial literacy in the podcast at: bit.ly/3r9YeTw

The survey was conducted on a representative sample of 1,000 adult respondents using the CAWI (online panel) data collection method in the second quarter of 2023.