AKO survey on Slovaks and their debt: 6.6% of Slovaks have debts that they cannot repay, young families are the most indebted, older people repay better.

Bratislava, 17.3.2023

Up to 6.6 per cent of the adult population in the Slovak Republic is unable to repay its debts. This is according to a recent survey conducted by EOS KSI Slovensko in cooperation with AKO.

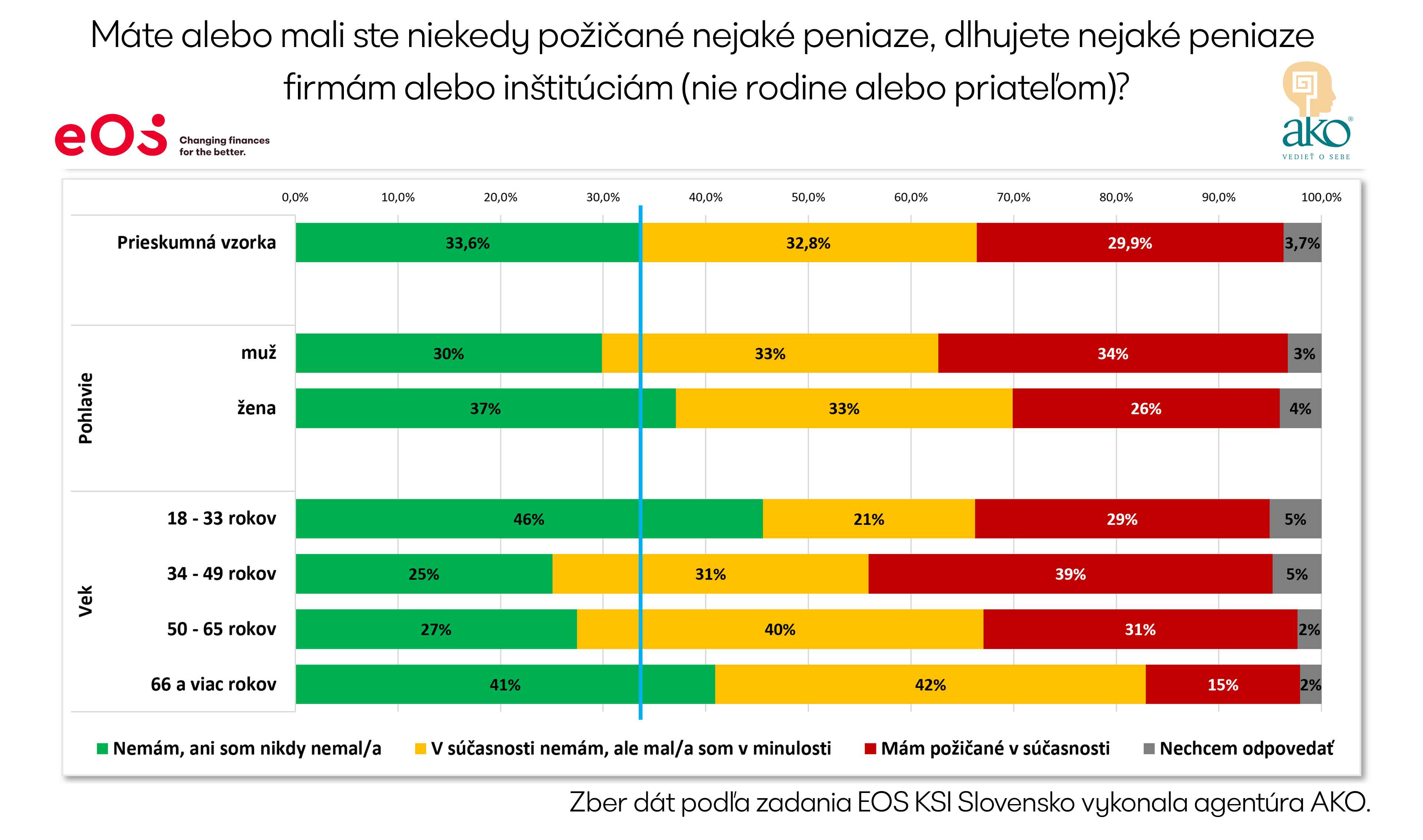

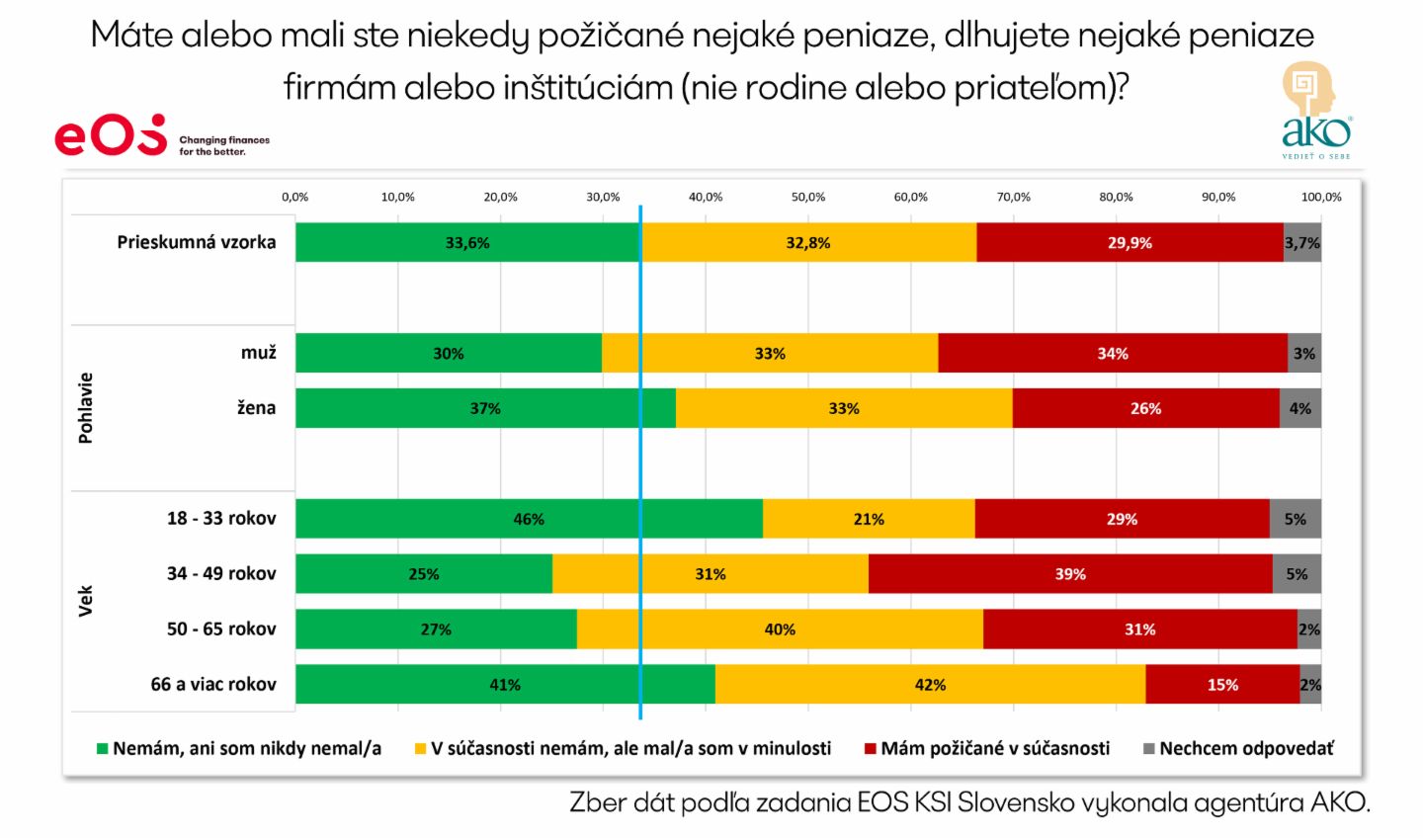

"This is an alarming figure," warns Václav Hřích, director of AKO, because in these cases it is not only people who fail to pay their loans, but also, for example, their housing, energy, water and telecommunication bills, and they are borrowing even to buy basic necessities for their families. EOS KSI Slovakia Director Peter Dvornák confirms the overlap between the survey figures and reality: "The group aged 34 to 49 with young children is above average in failing to pay their debts. This is logically related to the effects of inflation and the fact that this is the most heavily indebted age group."

Roughly 7% (approx. 289 thousand) of the population over 18 years of age admitted that they do not understand the area of finance and debt at all. Only three out of 10 understand the issue and two thirds of those surveyed understand it partially. Debt was defined in the survey as any overdue obligation to a bank, leasing company, instalment sale or supplier of services such as electricity, gas, water, telecommunications or insurance.

Residents of the Bratislava region, which is also the richest, are more likely to pay their debts on time. The largest number of indebted people live in the Trnava and Trenčín regions.

Higher levels of debt understanding were declared by university educated people, men, the age group from 34 to 49 years, residents of the Bratislava and Prešov regions, people with higher incomes, couples with children, as well as single people. Low understanding of finances and debts was declared by women, people in the age group of 18 to 33 years, respondents with primary or apprenticeship education, people with income up to EUR 300, people living with relatives without a share of household costs.

Families with children and people with the lowest incomes are more likely to have repayment problems. Depending on the type of household, the most likely to repay are couples without children who have no family expenses. Similarly, single people have a stronger payment discipline.

"Many younger people with decent incomes and higher education have racked up higher loans. The standard of living for this group included having two cars in the family on lease, a high mortgage, or an investment loan in an investment property," offers EOS KSI Slovensko Director Peter Dvornák in explanation of the data. Corresponding to this assumption is the finding that young people approach the need for credit as a wise decision that will help them acquire assets and invest well.

In contrast to the young in their attitudes to debt is the group of seniors over 66, for whom the fact that they have debt would probably be a feeling of shame.

The survey was conducted on a representative sample of 1,000 adult respondents using the CAWI (online panel) data collection method between May 18 and June 2, 2023.